Understanding Tax Audit Under Section 44AB: A Complete Guide

In the framework of Indian taxation the necessary procedure of tax audit serves to ascertain the truthfulness of reported incomes together with deduction assertions filed by taxpayers. The process enables clear documentation together with tax compliance while maintaining accurate records of financial transactions. The tax audit as defined by 44ab of the income tax act performs an assessment to verify taxpayer documentation accuracy and regulatory compliance. This article investigates the tax audit system from a holistic standpoint including Section 44AB paragraphs alongside applicable tax conditions and mandatory reporting criteria and GST audit connections. Each taxpayer and professional and business owner must understand income tax and auditing requirements to avoid penalties and maintain compliance.

What is a Tax Audit?

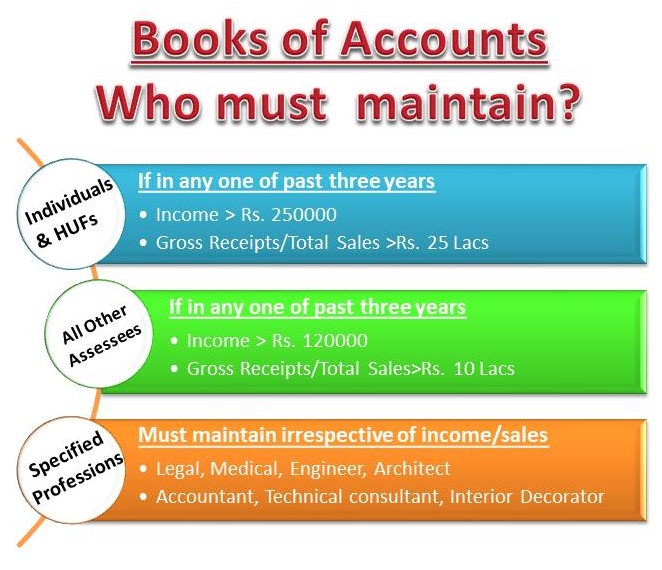

A tax audit requires an examination of taxpayer financial records and statements alongside compliance checks against income tax audit provisions. Under the income tax tax audit system the audit checks whether declared income amounts and claims and deductions match actual records. The income tax act requires specific people and organizations to undertake tax audits through section 44ab. The primary function of tax audit serves two purposes: preventing tax evasion and improving accountability while protecting taxation system integrity. Under Section 44AB of the Income Tax Act tax audit requirements apply Section 44AB of the Income Tax Act from 1961 requires tax audits to be conducted at the following times: Business: A tax audit is required when total turnover or gross receipts surpass ₹1 crore in a financial year. The maximum monetary threshold becomes ₹10 crore for businesses when their cash transactions stay under 5% of all receipt and payment flows. Profession: Tax audit must be conducted when the financial year’s gross receipts surpass ₹50 lakh. Every business or professional entity including individuals, HUFs, partnerships firms and LLPs and companies must meet the 44ab specified threshold. The income tax provisions found in Section 44ab require businesses and professionals who distribute large amounts of money to establish complete financial records for reporting purposes. The non-compliance of Section 44ab income tax act results in penalties and added interest charges.

| Objective | Purpose |

|---|---|

| Ensure Accuracy of Financial Records | To confirm that accounts are properly maintained and reflect true income. |

| Verify Compliance with Income Tax Law | To ensure the assessee follows provisions of the Income Tax Act. |

| Identify Taxable Income Clearly | Helps in computing correct taxable income and tax liability. |

| Prevent Tax Evasion | Detects misreporting, false claims, or overstatements of deductions. |

| Support Transparency and Accountability | Builds trust between businesses and tax authorities. |

| Assist in Tax Assessments | Helps tax authorities with quicker and more accurate assessments. |

| Promote Voluntary Compliance | Encourages businesses to stay within the law and avoid penalties. |

Due Date for Filing Tax Audit Reports

Tax Audit reports need submission before September 30th during the designated assessment year A tax audit report must reach the authorities by September 30 of the assessment year in question. Taxpayers who fail to file their tax audit report before 30th September will be subject to Section 271B penalties equal to 0.5% of their total sales/gross receipts or ₹1,50,000—whichever amount is lower.

The deadline for following income tax guidelines established under 44ab remains critical for businesses.

Penalty for Non-Compliance with Section 44AB

The failure to conduct book audits according to the requirements of Section 44AB of the Income Tax Act will result in penalties. When taxpayers demonstrate reasonable reasons such as natural calamities or unavoidable circumstances to support their failure to comply they may receive waived penalties. Failure to comply with income tax audit requirements represents a legal necessity that leads to substantial penalties for non-compliance.

Role of Chartered Accountants in Tax Audit

The tax audit process requires qualified Chartered Accountants to perform their duties Under Section 44ab of the income tax act only certified Chartered Accountants (CAs) have the authority to conduct tax audits. A CA requires accurate examination of business accounts coupled with compliance assessment before preparing and submitting tax audit reports within the required time period. A CA fulfills a critical function to maintain accurate tax audit assessments as well as providing guidance to taxpayers about audit-related tax matters and deductions. Correct bookkeeping maintains its essential position within the framework of tax compliance.

Importance of Maintaining Proper Books of Accounts

For an effective tax audit, it is necessary to maintain accurate books. The following records are commonly required:

Profit and loss account

Balance sheet

Cash book

Ledger

Purchase and sales register

Expense vouchers

Good bookkeeping simplifies the income tax audit process and ensures that the audit taxation is completed without complications.

Recent Amendments in Tax Audit Provisions

The Tax Audit Provisions underwent recent adjustments The Finance Act added several amendments to Section 44AB through increased audit threshold levels at ₹10 crore except for cash transaction restrictions. The government implemented these changes to boost digital payments while lightening regulatory requirements for local businesses. To offer proper tax guidance to clients professionals need to stay updated about all recent modifications made to 44ab income tax regulations.

Common Errors to Avoid in Tax Audit

Taxpayers and professionals should avoid these common errors:

Incorrect classification of income

Delay in submission of forms

Non-compliance with TDS/TCS provisions

Mismatch in reported figures

Ignoring changes in 44ab of income tax act

Such mistakes in the audit of income tax process can lead to notices, penalties, and audits.

Tax Audit and Income Disclosure

The income tax and auditing process also helps identify discrepancies in income disclosure. A tax audit provides a systematic report of:

Total income earned

Deductions claimed

Tax payable or refund due

Hence, income tax tax audit plays a key role in the overall compliance and transparency of financial affairs.

Conclusion

A tax audit is a vital mechanism for ensuring tax compliance, especially for businesses and professionals with significant turnover. The provisions of 44ab of income tax act set the foundation for this auditing system. Complying with income tax audit norms, maintaining books, and filing reports on time can save taxpayers from penalties and ensure a smooth taxation journey.

Moreover, with the interplay of audit gst, audit taxation, and income tax and auditing norms, businesses today need expert guidance. By staying updated with 44ab income tax rules and availing professional help, one can manage both legal obligations and financial discipline.