The Ultimate Guide to Angel Investment: Unlocking Early-Stage Growth

Angel investment is a crucial funding source for early-stage businesses, providing capital, mentorship, and market access. It helps startups scale innovative ideas into successful ventures. As one of the Best Chartered Accountants in India, we guide entrepreneurs through the angel funding process—ensuring financial readiness, fair valuation, and compliance. With expert structuring, angel investment becomes more than money; it’s a growth partnership that drives long-term success for startups aiming to compete in today’s dynamic business environment.

What is Angel Investment?

Angel investment refers to financial backing from high-net-worth individuals, known as angel investors, who support early-stage businesses in exchange for equity or convertible debt. Using their own funds, they offer not only capital but also mentorship, industry connections, and strategic advice. As one of the Best Chartered Accountants in India, we help startups prepare for and secure angel investment effectively. Often following contributions from friends and family, angel funding is the first significant boost, enabling entrepreneurs to develop prototypes, conduct market research, and launch products before seeking larger venture capital financing.

Angel Capitalists: Who Are They?

Angel investment comes from angel capitalists—wealthy individuals who use personal funds to back early-stage startups in exchange for equity or convertible debt. Unlike venture capitalists, they invest their own money, often motivated by passion, mentorship opportunities, or high-return potential. As one of the Best Chartered Accountants in India, we help startups secure such funding effectively.

| Feature | Description |

|---|---|

| 💰 High Net Worth | Usually accredited investors with significant disposable income. |

| 🚀 Early-Stage Focus | Invest during the seed or pre-seed stage—before VCs. |

| 🔁 Equity-Based | Receive shares or convertible notes in return for funding. |

| 🧠 Mentorship Role | Offer guidance, industry connections, and startup advice. |

| 🎯 Risk-Tolerant | Comfortable with high-risk, high-reward opportunities. |

What Makes Angel Financiers Unique?

Angel investment comes from private individuals—known as angel financiers—who use their own money to back early-stage startups, often when other funding sources are unavailable. What sets them apart is not only the capital they provide but also mentorship, strategic advice, and a genuine belief in the founder’s vision. Unlike venture capitalists, they typically invest during the pre-seed or seed stage, helping turn ideas into viable businesses. Many are former entrepreneurs or industry experts, offering networking opportunities, operational guidance, and industry insights. As one of the Best Chartered Accountants in India, we help startups prepare for and attract angel investment, ensuring deals are structured for long-term growth. Their speed, flexibility, and emotional investment make angel financiers a lifeline for ambitious startups.

How to Attract Angel Investment

| Step | Description | Key Tips |

|---|---|---|

| 1. Build a Solid Business Plan | Create a clear, compelling business plan that outlines your value proposition, target market, revenue model, and growth projections. | Include financial forecasts, competitor analysis, and go-to-market strategy. |

| 2. Create an Impressive Pitch Deck | A visual presentation that explains your startup’s story, mission, problem/solution, business model, traction, and funding ask. | Keep it to 10–15 slides, focus on clarity and impact. |

| 3. Validate Your Idea | Show traction: user growth, revenue, prototypes, pilot programs, or customer testimonials. | Angels love signs of real-world demand. |

| 4. Build a Strong Founding Team | Investors look for a capable, coachable, and committed team with complementary skills. | Highlight founders’ experience, domain expertise, and passion. |

| 5. Network With the Right People | Attend startup events, join incubators, and connect via platforms like AngelList, LinkedIn, or angel networks. | Warm intros work best—leverage mentors or advisors. |

| 6. Be Transparent and Coachable | Be honest about risks, gaps, and how you plan to overcome them. Be open to feedback and adaptable. | Trustworthiness is just as important as ambition. |

| 7. Understand Your Valuation | Know how much equity you’re offering and justify your startup’s worth with realistic numbers. | Don’t overvalue too early—it scares off savvy angels. |

| 8. Choose the Right Angel | Not all money is smart money. Look for investors who add value beyond cas |

Angel Investment Trends

Angel investment is an early-stage funding method where a high-net-worth individual invests personal capital in a startup for equity or convertible debt. Often occurring at the seed or pre-seed stage, it bridges the gap when traditional financing is unavailable. As one of the Best Chartered Accountants in India, we guide startups in securing such funding.

The Dangers and Benefits of Angel Investment

| Benefit | Description |

|---|---|

| 💸 Early Access to Capital | Angel investors fund startups when banks and VCs won’t—often at the idea or prototype stage. |

| 🤝 Mentorship & Expertise | Many angels are former entrepreneurs or industry experts who provide strategic guidance and networking. |

| 🚀 Faster Funding Process | Angel investment deals can close faster than VC rounds, with fewer formalities. |

| 🎯 Flexible Terms | Angels may offer more founder-friendly terms, such as lower equity demands or convertible notes. |

| 🌍 Credibility Boost | Being backed by a respected angel can improve your visibility and attract future investors. |

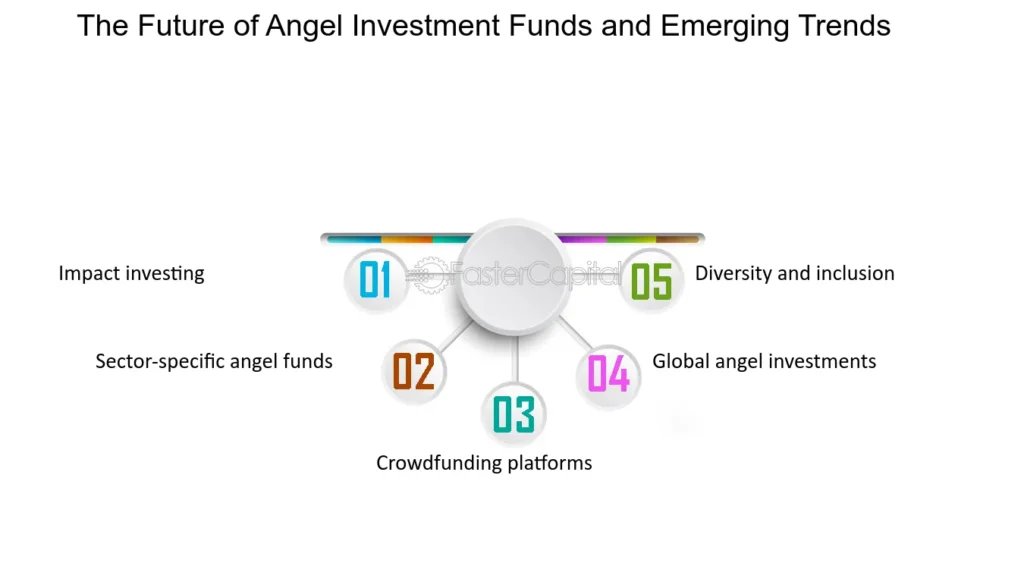

Angel Investment's Future

The future of angel investment is becoming more tech-driven, inclusive, and global. Startups in sectors like climate tech, biotech, and Web3 are attracting investors who act as strategic partners, offering mentorship and industry expertise. As one of the Best Chartered Accountants in India, we help entrepreneurs prepare for and leverage this evolving funding landscape.

Fintech, AI, and blockchain are transforming how deals are sourced, analyzed, and managed, while crowdfunding platforms and syndicates are enabling wider participation in early-stage funding. With impact investing and diversified portfolios gaining traction, angel investment will remain a vital driver of innovation, empowering the next generation of entrepreneurs and fueling business growth across industries.

Conclusion

Angel investment is more than early-stage funding — it’s a catalyst for innovation, mentorship, and sustainable growth. As technology reduces entry barriers and industries evolve, the role of angel investors will only grow. Recognized among the Best Chartered Accountants in India, we guide startups in preparing for such funding opportunities. With smarter tools, wider access, and impact-driven goals, angel investment is poised to shape the future of entrepreneurship and drive lasting change in the global economy.